A High Production Rate Solves Many Ills

An Overview of Production Line: Car Factory Simulation

A friend recently introduced me to Production Line, a game about building an automotive company. Over the holiday weekend, I fired it up and channeled my inner Elon Musk and plowed my precious seed dollars into a building a brand new sedan and the factory to produce it. Little did I know that I would be teetering on the edge of bankruptcy repeatedly, just like Musk, as I raced ahead to scale production as fast possible. I’ve put together a quick walk-through of the game for you all to enjoy.

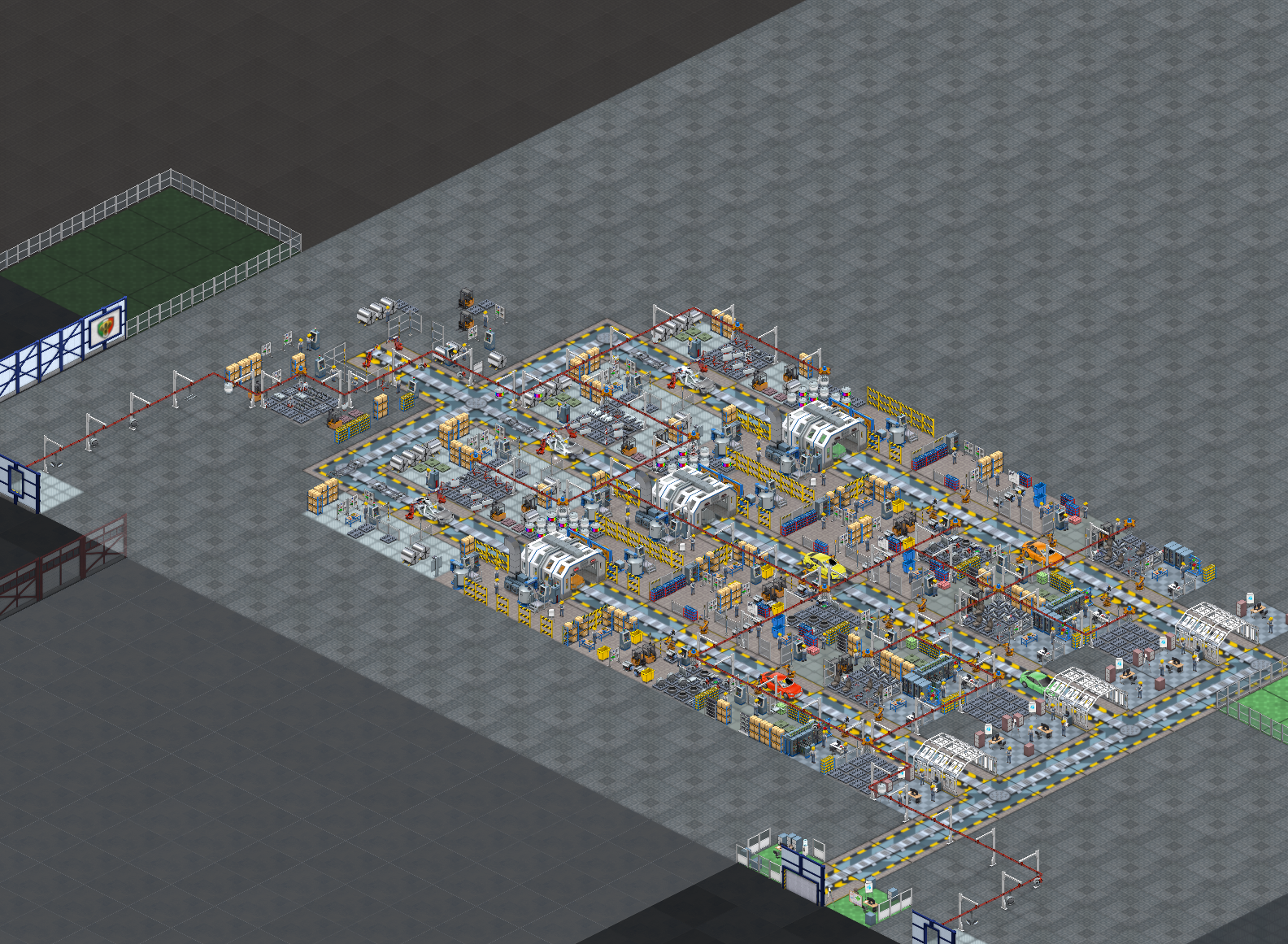

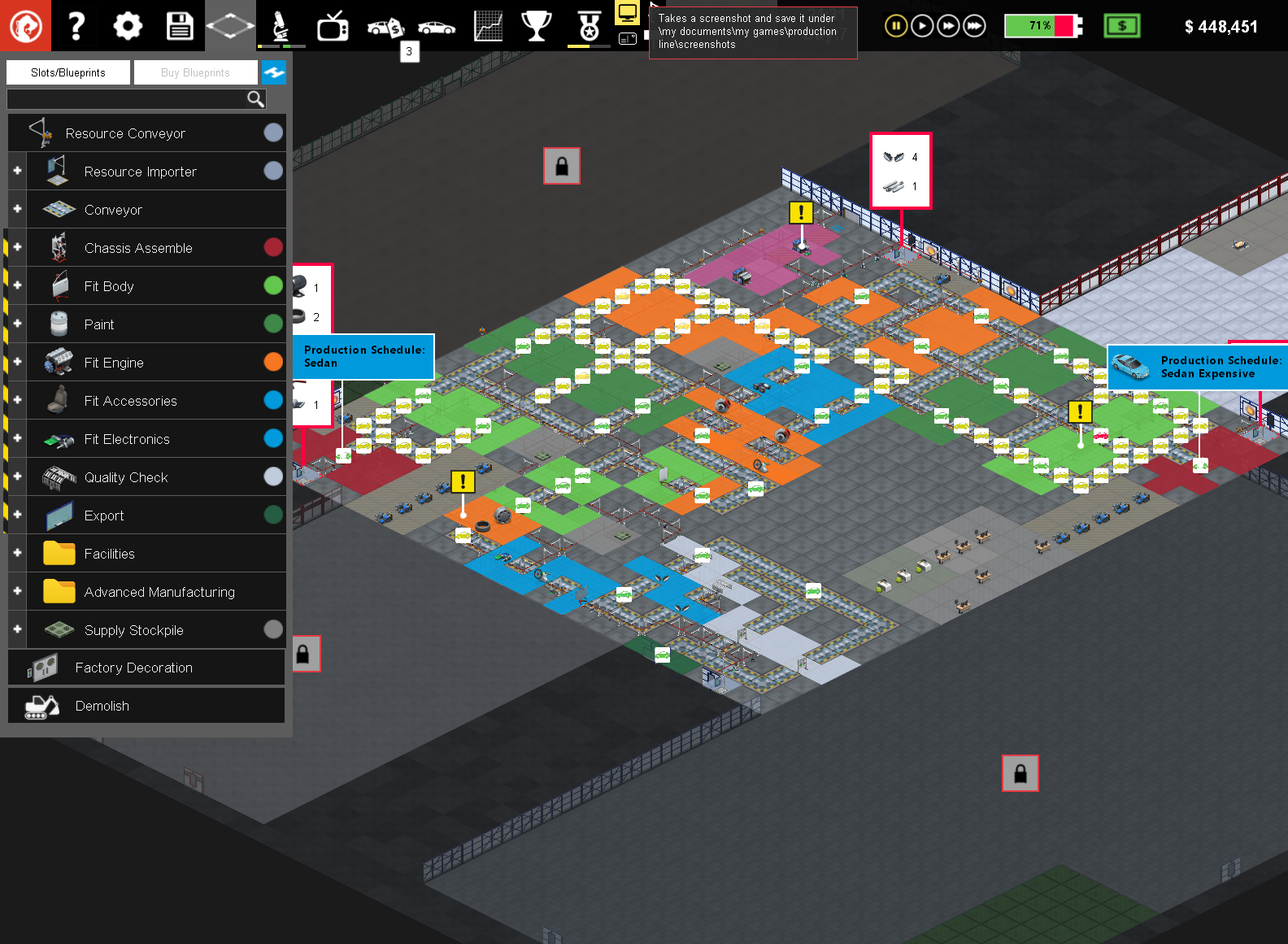

Starting out, I skipped all instructions on how to play and started a new company, Baboo Industries. I bought a small factory and had $1.3M leftover to buy factory equipment. As I laid out my first line, I placed the starting station, chassis assembly, into the front of the factory near the receiving docks and ended with a quality inspection precisely aligned with the export door. The sedans I would be producing would have their chassis assembles every 13 minutes then traverse one of three sub lines consisting of body panel assembly, paint, powertrain fit, accessories fit, and electronics fit stations before being inspected for defects and exported to the dealership showroom. The planned bottleneck was initially the paint shop, clocking in with a cycle time of 34 minutes and 24 seconds, but as the game progressed that changed rapidly and I was wishing I had read the instructions.

As the days progressed, the sedan was selling well so I needed to commission a new line. I took out a loan at a high interest rate and started laying out my second line which began in the complete opposite corner of the factory. The goal was to balance the overall throughput of the factory by having separate lines for the long running operations of body panel assembly, paint, and powertrain fit then merge the lines for quick operations such as accessories and electronics fit. Along the way I had researched new features for the sedan such as a start-stop engine, cruise control, and electronic windows alongside factory efficiency technologies such as faster robots and conveyors. These changes to both the car being produced and each station efficiency dramatically changed where the bottlenecks occurred within the lines. It was a constant struggle to add and remove stations while keeping the line moving and investing in new features that customers wanted.

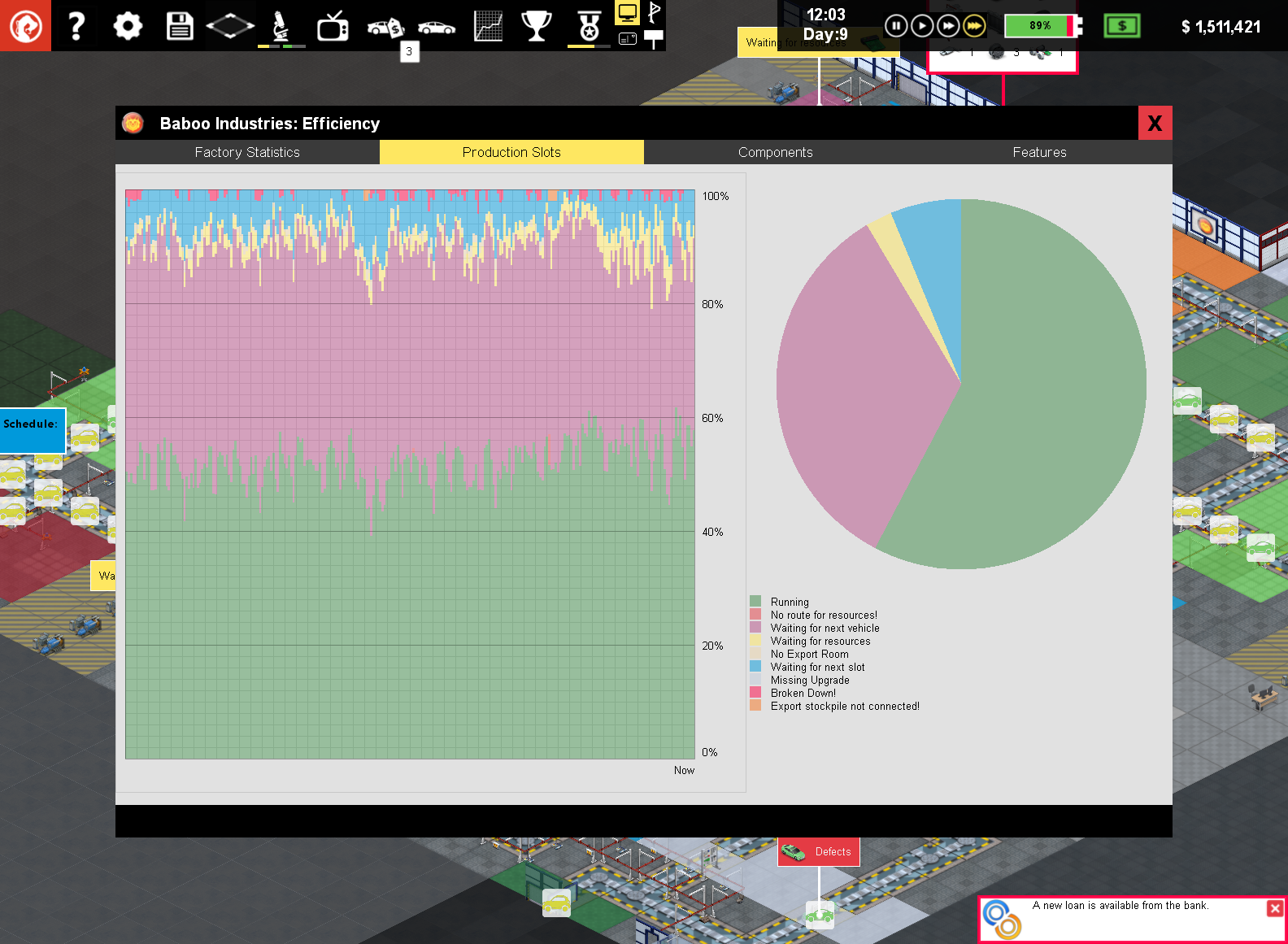

I was able to keep my factory running efficiently enough to have strong margins on the sedan model. Across all stations, the factory was running between 40 and 60% of the time with the remainder largely attributed to waiting for the next vehicle. Getting components imported into each station was of little impact to any machine availability issues. Throughout the game, I utilized all my cash flow from operations and tried to manage debt levels while continually reinvesting in new features for the sedan model and improving efficiency on the production lines. The demand for my sedan waned at times due to commoditized features so I also needed to generate new demand by pulling some marketing levers. Lastly, my strong margins allowed me to considerably cut price when needed to move the sedan into a lower market segment and generate plenty new cash for the business to avoid bankruptcy.

Car Factory Takeaways

Overall, the game is both quite fun and realistic and brings into perspective the opportunities of Industry 4.0. While I was playing, I often tore out production stations and built new ones in real time while trying to produce cars with no planning. If I had the ~ability~ patience to use digital twins to plan and simulate line throughput while optimizing for cost I would have been considerably less wasteful. If I had analytics to assist in demand planning and real-time assessment of customer feedback I could have made my product development priorities align to better margin profiles and focused on unmet market niches.

Back in the real world, Rivian continues to ramps production and Production Line gives me a new perspective as to how they turn their backlog of trucks into cash and reinvest in product development and operations. Production Line provides a realistic experience of the pain and risk reward that comes with being an upstart automotive firm. It dawned on me while taking a break from playing and watching a video about SpaceX’s Raptor engine (below) that when Elon repeatedly said, “A high production rate solves many ills” exactly captured the essence required to be successful at both Production Line and real world manufacturing businesses. By having a high production rate it affords many iterations to improve efficiency and enhance product market fit before running out of cash. The developers should add that maxim into the instructions for Production Line.

Assembly Line

Capturing this week's trending industry 4.0 and emerging industrial technology media

The 100% Recyclable Running Shoe That’s Only Available by Subscription

To make a shoe that can be ground up, melted down and reincarnated as another shoe, Swiss sportswear brand On didn’t just need new materials and manufacturing processes. It designed a new sales model. In June, On began shipping the first 10,000 pairs of its latest model, starting with U.S. customers. The Cloudneo is pitched as “the shoe you will never own.” Instead, runners pay $29.99 a month for an endless supply, provided they return worn-out pairs to be recycled. On executives say this arrangement will lock in a supply of raw material for new shoes, reducing waste.

Heineken’s Event-Driven Connectivity Strategy

To understand the scope of this connectivity project, it’s important to realize that Heineken runs more than 3,500 applications globally, connecting them with more than 5,000 interfaces. ERP systems in use across the company include SAP, Oracle’s JD Edwards, and Microsoft Dynamics, as well as the Hybris and Virto e-commerce platforms, Salesforce customer relationship management, and various manufacturing execution and invoicing systems.

Groeneweg adds that, with its new event-driven system in place, Heineken can now deploy scalable “plug-and-play” technologies quickly to take advantage of timely business insights at scale. To explain this, Groeneweg offers an example involving the introduction of a new global invoice management application. Before the implementation of Heineken’s event-driven system, multiple point-to-point integrations would need to be built to embed the new application into the company’s IT landscape. “We would have to connect it to at least 20 applications to get master data, ERP data, customer data, etc.,” says Groeneweg. “With the event-driven approach, we just point the chatbot to the right topics and queues where the data is already available from all the source systems it needs to access. No integration work is required at all.”

How to Calculate Production Line Efficiency and Increase Your Throughput

As the filler is usually the most expensive machine on the line, we are in business and can move forward on ways to keep it running. We will aim to get the line’s throughput as close to the 167 bottles per minute (BPM) figure as possible.

Accumulation systems are designed to create buffers when a machine goes down to prevent having to shut down the entire line. Remember, we want to keep the constraint running as much as possible. By adding one or more accumulators on the line, you can avoid shutting down the constraint as you get your other machines back up. This can get the line’s throughput as close to the constraint’s maximum throughput as possible. Again, we will use our example to show you what happens when adding accumulation.

Elon Musk Explains SpaceX's Raptor Engine!

Pleora’s Visual Inspection System Ensures End-to-End Quality for DICA Electronics

DICA Electronics Ltd is deploying Pleora’s Visual Inspection System to reduce manufacturing quality escapes and gather key data from manual processes to help speed root cause analysis. The system uniquely requires just one image to start using AI, with continuous and transparent training based on operator actions to improve and speed automated decision support. With just one good image, Inspection apps for incoming, in-process, and final quality control steps automatically compare products to a “golden reference” and visually highlight differences and deviations for an operator. As the operator accepts or rejects potential errors, the AI model is transparently trained based on their decisions. After even just one inspection, the AI model will start automatically suggesting a decision for the operator. Over time, the speed and accuracy of automated decision-making will improve as the system continuously learns from operator preferences. In comparison, most AI inspection tools require numerous good and bad images plus time-consuming and expensive algorithm development before they can be deployed in production.

End to End 3D Printing with Velo3D CEO Benny Buller

Capital Expenditure

Tracking this week's major mergers, partnerships, and funding events in manufacturing and supply chain

VulcanForms Announces Capital Raise of $355 Million and Pioneers Industrial-Scale Digital Manufacturing Infrastructure

VulcanForms, a MIT-born company that builds and operates advanced digital manufacturing infrastructure, announced today it has raised $355 million and is valued at over $1 billion. VulcanForms’ investors include Eclipse Ventures, Stata Venture Partners, Fontinalis Partners, D1 Capital Partners, Standard Investments, Atlas Innovate, Boston Seed Capital, Industry Ventures, and the Simkins Family. The company also revealed its first two digital production facilities, in Devens, MA and Newburyport, MA, capturing the full value chain for precision metal components and assemblies.

VulcanForms’ customers include leading companies in the aviation, space, defense, medical, semiconductor, and other critical industries. For instance, the company supplies over a dozen U.S. Department of Defense programs, including the F35 Joint Strike Fighter and Patriot Air Defense System, has delivered thousands of components for the semiconductor industry, and is enabling innovation in medical implants. By combining its breakthrough technology, a data- and simulation-based digital thread, and operational excellence, VulcanForms’ integrated approach allows its customers to innovate faster and produce more without the need to make major capital investments and implement new manufacturing technologies from scratch.

Flexe Raises $119M as Enterprises Accelerate Flexe Logistics Program Adoption

Flexe, the programmatic logistics leader, announced its $119 million Series D funding round at a $1b+ post-money valuation. The round includes new investments from funds and accounts managed by BlackRock and follow-on investment from Activate Capital, Madrona Ventures, Prologis Ventures, Redpoint Ventures, funds and accounts advised by T. Rowe Price Associates, Inc. and T. Rowe Price Investment Management, Inc. and Tiger Global.

Flexe continues to see accelerated demand for its logistics programs. An uncertain macroeconomic environment, rapidly shifting consumer behaviors, forecast variability and supply chain gridlocks have led retailers and brands to strategically embrace logistics flexibility.

Celus grabs $25M in Series A funding to automate electronic circuit board design

German startup Celus GmbH announced today it has raised $25 million in a new round of funding to help further its goal of using artificial intelligence to streamline printed circuit board development. Today’s Series A round was led by Earlybird Venture Capital and saw participation from DI Capital plus existing investors Speedinvest and Plug and Play.

The startup plans to use the cash from today’s funding round to scale its business and grow more, with a focus on expansion into the U.S. It will also expand its commercial teams and executive leadership. Celus co-founder and Chief Executive Tobias Pohl said the company will open an office in the U.S. in order to position itself in the heart of the electronics industry. “We want to reach every electronics designer out there, enabling them to focus more time on innovation and creativity, while our software reduces the tedious and time-consuming tasks they were dealing with before,” he said.

Sortera Alloys Announces $10M Funding Round to Advance End-of-Life Recycling for Automotive Metals

Sortera Alloys, Inc., an innovative industrial scrap metal sorting and recycling company powered by A.I. imagery, data analytics, and advanced sensors, announced $10M in funding led by Assembly Ventures with additional funding from Breakthrough Energy Ventures and Novelis. Sortera is dedicated to providing a solution for end-of-life circular recycling in the aluminum industry.

Sortera’s A.I.-powered technology allows existing streams of mixed alloy aluminum scrap to be separated back into individual alloys. The upgraded metals can then be recycled back into the highest value applications ranging from automotive cast and flat-rolled products to building, construction, and aerospace materials extrusions. The company’s low-cost, scalable production process enables customers to reduce their CO₂ footprint and achieve sustainability and circular production goals due to the fact that recycled aluminum requires roughly 95% less energy to produce than aluminum produced from virgin raw materials.